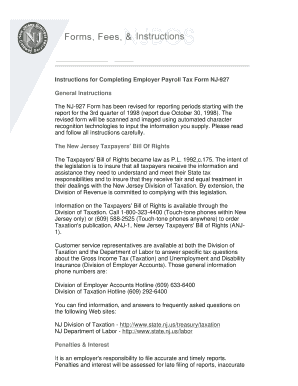

Get the free nj927

Show details

NJ927 - Employer s Quarterly Report Page 1 of 3 State of New Jersey Employer s Quarterly Report FEIN 232-888-091/000 NJ927W Quarter/Yr 1/2009 Business Name TEST CASE 04 Return Due Date 04/30/2009 T Quarter Ending Date 03/31/2009 Date Filed Not Filed GIT Amounts Withheld For Quarter AF Enter GIT Amount Withheld Each Period Press the line description on the left for help Week/Period Amount 01/01-01/03 02/15-02/21 02/22-02/28 01/11-01/17 03/01-03/07...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nj 927 form

Edit your nj 927 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj 927 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nj927 form online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form nj 927. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nj927 online form

How to fill out NJ 927 form:

01

Begin by obtaining a copy of the NJ 927 form. You can download it from the official website of the New Jersey Division of Taxation or request a copy through mail.

02

Start by entering your business name, address, and federal employer identification number (FEIN) at the top of the form.

03

Fill in the period covered by the form in the designated section. This includes the start date and the end date of the reporting period.

04

Next, report the total taxable wages paid to employees during the reporting period. This includes regular wages, overtime, bonuses, commissions, and all other compensation subject to New Jersey payroll taxes.

05

Calculate and report the total amount of New Jersey Gross Income Tax withheld from employee wages during the reporting period.

06

Determine the total amount of New Jersey Unemployment Insurance (UI) contributions owed by your business for the reporting period. This is calculated based on the taxable wages subject to UI tax.

07

If applicable, report any additional withholding taxes, such as New Jersey Family Leave Insurance, Workforce Development Partnership, or Disability Insurance.

08

Once all the necessary information is entered, compute the total tax liability by adding up the amounts from each section.

09

Sign and date the form to certify its accuracy.

10

Submit the NJ 927 form along with the required payment to the New Jersey Division of Taxation by the specified due date.

Who needs NJ 927 form:

01

Employers who conduct business in New Jersey and have employees on their payroll are required to file the NJ 927 form.

02

This includes businesses of all sizes, whether they are corporations, partnerships, sole proprietorships, or limited liability companies.

03

Employers must file the NJ 927 form quarterly to report their employees' wages, New Jersey Gross Income Tax withheld, and Unemployment Insurance contributions.

Fill

pdffiller

: Try Risk Free

People Also Ask about nj form 927

Who has to file NJ-927?

Each calendar quarter, all employers, other than domestic employers, subject to the provisions of the Unemployment Compensation Law are required to file the “Employer's Quarterly Report” (Form NJ-927) and “Employer Report of Wages Paid” (Form WR-30).

How do I close my NJ employer withholding account?

Close your withholding account: Option 1: Submit an Online Registration Change (REG-C) indicating the date on which payment of wages ceased. When in the online portal, please select "End Tax Eligibility" option. Then under "Select a tax" select "Giter/UI/DI" and indicate the date on which payment of wages ceased.

How do I close my New Jersey withholding account?

Close your withholding account: Option 1: Submit an Online Registration Change (REG-C) indicating the date on which payment of wages ceased. When in the online portal, please select "End Tax Eligibility" option. Then under "Select a tax" select "Giter/UI/DI" and indicate the date on which payment of wages ceased.

What form do I use for NJ part year resident return?

Part-year residents may be required to file a New Jersey tax return. Since New Jersey does not have a special form for part-year filers, you must use the regular resident return, Form NJ-1040. The return provides a line for you to show the period of your residency in the state.

How do I cancel payroll in NJ?

Submit an Online Registration Change (REG4C) on the Division of Revenue! s Web site (.state.nj.us/treasury/revenue/), or send a Request for Change of Registration Information (Form REG4C, Form REG4C4H, or Form REG4C4L) by mail to indicate the date on which operations (and payment of wages) ceased.

What is the New Jersey 927 form?

Employer Payroll Tax Forms Return NumberReturn NameNJ-927-HDomestic Employer's Annual Return - OnlineNJ-W4Employee's Withholding Allowance CertificateNJ-927Employer's Quarterly Reports - OnlineNJ-927WEmployer's Quarterly Reports - Online12 more rows • Oct 17, 2022

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in nj 927 form sample without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit nj 927 form pdf download and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the form 927 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your nj wr 30 form pdf and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out file nj927 online on an Android device?

Use the pdfFiller Android app to finish your nj 927 online and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is nj 927 form pdf?

The NJ-927 form is a tax form used by employers in New Jersey to report employee wages and the employer's and employee's contributions towards state unemployment and disability insurance.

Who is required to file nj 927 form pdf?

Employers who have employees working in New Jersey and are liable for unemployment insurance are required to file the NJ-927 form.

How to fill out nj 927 form pdf?

To fill out the NJ-927 form, employers must provide details about the number of employees, total wages paid, and contributions made for unemployment and disability insurance, along with any necessary identification information.

What is the purpose of nj 927 form pdf?

The purpose of the NJ-927 form is to ensure compliance with state laws regarding unemployment and disability insurance contributions from employers based on their employees' wages.

What information must be reported on nj 927 form pdf?

The NJ-927 form requires reporting of total wages paid, the number of employees, and contributions made for unemployment and disability insurance for the reporting period.

Fill out your nj927 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj 927 Online Filing is not the form you're looking for?Search for another form here.

Keywords relevant to nj wr30

Related to new jersey 927

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.